-

November 30, 2017World Resources Institute

Roots of Prosperity: The Economics and Finance of Restoring Land

-

October 31, 2017WB

State and Trends of Carbon Pricing 2017

-

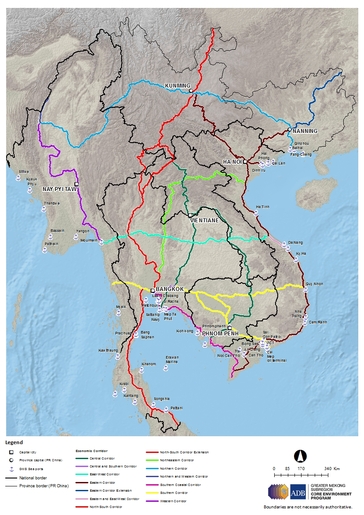

August 31, 2017ADB

Trade Facilitation and Better Connectivity for an Inclusive Asia and Pacific

-

August 31, 2017Frankfurt School-UNEP Collaborating Centre

Climate Metrics for Debt and Equity Portfolios: A Framework for Analysis

-

July 31, 2017ADB

Catalyzing Green Finance: A Concept for Leveraging Blended Finance for Green Development

-

June 30, 2017UNEP

Green Finance Progress Report 2017

-

May 31, 2017IUCN

Guidelines for tourism partnerships and concessions for protected areas: Generating sustainable revenues for conservation and development

-

May 15, 2017EcoAgriculture Partners, IUCN

Business for Sustainable Landscapes

-

April 30, 2017ADB

Banking on the Future of Asia and the Pacific: 50 Years of The Asian Development Bank

-

April 30, 2017ADB

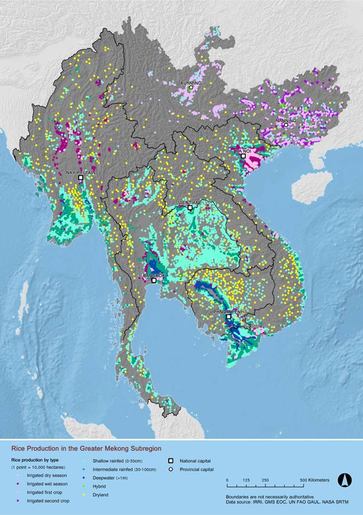

Financing Asian Irrigation: Choices Before Us

-

April 30, 2017ADB

Risk Financing for Rural Climate Resilience in the Greater Mekong Subregion

-

April 05, 2017Frankfurt School-UNEP Collaborating Centre

Global Trends in Renewable Energy Investment 2017

-

March 31, 2017ADB

Asian Development Outlook (ADO) 2017: Transcending the Middle-Income Challenge

-

March 31, 2017ADB

Clean Energy Financing Partnership Facility: Annual Report 2016

-

February 28, 2017ADB

Eradicating Poverty and Promoting Prosperity

-

February 28, 2017UNEP

Resource Efficiency: Potential and Economic Implications

-

February 28, 2017Mekong Institute

BASELINE SURVEY REPORT: Enhancing Competitiveness of Small and Medium-Sized Enterprises In The Southern Economic Corridor of ASEAN Mekong Sub-Region (AMS)

-

February 28, 2017ADB

Economics of Climate Change Mitigation in Central and West Asia

-

January 18, 2017ASEAN

Investing in ASEAN 2017

-

December 14, 2016ADB

Asian Economic Integration Report 2016

-

November 10, 2016WWF

The Mekong River in the Economy Report

-

October 31, 2016Mekong Institute

Study On Market & Value Chain Mapping in the Southern Economic Corridor and Southern Coastal Corridor of the Greater Mekong Subregion

-

October 31, 2016German Development Institute (DIE)

Green Finance: Actors, challenges and policy recommendations

-

September 30, 2016ADB

ADB - Disaster Risk in Asia and the Pacific: Assessment, Management and Finance

-

August 01, 2016Asian Development Bank

Video: New Road in Lao PDR Changes Everything

-

August 01, 2016Asian Development Bank

Greater Mekong Subregion Statistics on Growth, Infrastructure and Trade (Second Edition)

-

July 14, 2016Asian Development Bank

ADB - Natural Capital and the Rule of Law: Proceedings of the ADB Second Asian Judges Symposium on Environment 2013

-

June 14, 2016UNDP

Integrated Planning and Sustainable Development: Challenges and Opportunities

-

May 31, 2016UNEP, Global Infrastructure Basel (GIB)

Sustainable Infrastructure and Finance

-

May 17, 2016WWF

Natural Connections - How Natural Capital Supports Myanmars People and Economy

-

April 30, 2016IISD

State of Sustainability Initiatives Review: Standards and the Blue Economy

-

April 30, 2016UNEP

Green Finance and Developing Countries: Needs, Concerns and Innovations

-

January 11, 2016Asian Development Bank

Southeast Asia and the Economics of Global Climate Stabilization

-

November 30, 2015RECOFTC

Improving incomes of local people through the sustainable harvesting of timber

-

November 30, 2015ADB

Asian Economic Integration Report 2015: How Can Special Economic Zones Catalyze Economic Development?

-

November 17, 2015Oxfam

Working Paper on Economic, Environmental and Social Impacts of Hydropower Development Lower Mekong Basin

-

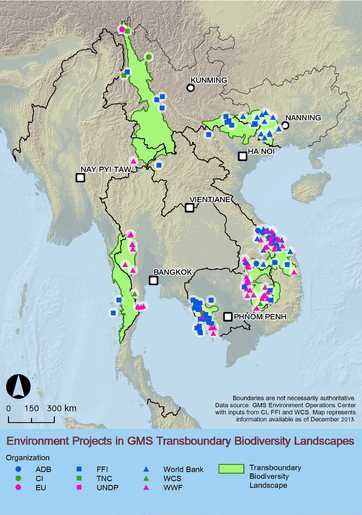

November 10, 2015GMS Core Environment Program

Investing in Natural Capital for a Sustainable Future in the Greater Mekong Subregion

-

September 15, 2015Asian Development Bank

Regional Investment Framework Implementation Plan - First Progress Report

-

September 13, 2015Asian Development Bank

Economic Analysis of Climate-Proofing Investment Projects

-

September 09, 2015ADB

Greater Mekong Subregion Statistics On Growth, Connectivity and Sustainable Development (First Edition)

-

May 31, 2015United Nations Environment Programme (UNEP)

Economic Valuation Of Wastewater: The Cost Of Action And The Cost Of No Action

-

April 14, 2015GMS Core Environment Program

Strategic Environmental Assessment in the Greater Mekong Subregion

-

February 28, 2015Grantham Research Institute on Climate Change and the Environment, GGGI

Looking for Green Jobs: The impact of green growth on employment

-

November 10, 2014OECD

Towards Green Growth in Southeast Asia

-

April 24, 2014SANDEE

Policy Brief: Operationalizing Environmental Economic National Accounts

-

April 14, 2014Asian Development Bank

Assessing Impact in the Greater Mekong Subregion: An Analysis of Regional Cooperation Projects

-

January 23, 2014UNEP

Building Natural Capital: How REDD+ Can Support A Green Economy

-

November 30, 2013Friedrich Ebert Stiftung

Green Growth Strategies in Asia: Drivers and Political Entry Points

-

November 27, 2013GMS Core Environment Program

Planning Sustainable Investments in the Greater Mekong Subregion

-

November 19, 2013WWF

Heart of Borneo: Investing in Nature for a Green Economy

-

July 16, 2013Center for International Forestry Research

Payments for Forest Environmental Services in Viet Nam - From Policy to Practice

-

June 30, 2013AfDB, OECD, UN and WB

A Toolkit of Policy Options to Support Inclusive Green Growth

-

26th March 2018

Source: Vientiane TimesLancang-Mekong Cooperation yields tangible benefits

-

18th March 2018

Source: The Third PoleCan the countries of the Mekong pioneer a new model of cooperation?

-

15th March 2018

Source: Inter Press ServiceGGGI to Assist Thailand to Close Financial Gaps for Green Growth

-

14th March 2018

Source: Bangkok PostGovt ready to scrap region border checks

-

14th March 2018

Source: The NationGovt to ease transport woes with neighbouring nations

-

13th March 2018

Source: The IndependentUnderstanding Nanning’s strategic roles in China-ASEAN cooperation

-

13th March 2018

Source: Viet Nam News$66b invested in Greater Mekong Sub-region: ADB official

-

12th March 2018

Source: Khmer TimesEngendering an inclusive Asean

-

12th March 2018

Source: UN EnvironmentBuilding for green growth in Thailand

-

25th February 2018

Source: Khmer TimesADB to finance Asean energy project

-

3rd February 2018

Source: National News Bureau of ThailandThailand - Wildlife corridor will boost ecology and economy, says Transport Minister

-

2nd February 2018

Source: The NationLaos-China Belt and Road Cooperation Forum kicks off

-

1st February 2018

Source: Lao News AgencyBelt and Road Forum for Laos-China Cooperation Opens

-

31st January 2018

Source: Khmer TimesCambodia to open more trade centres in China

-

23rd January 2018

Source: ReutersChina's Premier Li calls for more targeted economic policy

-

11th January 2018

Source: Khmer TimesCambodia - Key agreements signed with China on expressway, airport

-

10th January 2018

Source: Bangkok PostThailand - Riverside nations adopt Mekong action plan

-

10th January 2018

Source: Lao News AgencyLao PDR - Laos to Co-host MLC Meeting

-

4th January 2018

Source: ANNLaos could sustain economic growth through mega projects

-

4th January 2018

Source: Khmer TimesCambodia - GMS to enhance cooperation

-

2nd January 2018

Source: Vientiane TimesLao PDR - China injects 29b kip for Mekong-Lancang projects

-

28th December 2017

Source: Vientiane TimesLao PDR - Borikhamxay kicks off tourism year

-

27th December 2017

Source: Vientiane TimesLao PDR - Govt vows to improve investment climate to drive growth

-

27th December 2017

Source: Khmer TimesCambodia - Local firm plans massive shipment of mangoes

-

26th December 2017

Source: Bangkok PostVietnam's economic growth quickens to 6.81% in 2017

-

25th December 2017

Source: Khmer TimesCambodia - Chinese market widening for Cambodian exports

-

9th December 2017

Source: VietNamNet BridgeVietnam advised to import electricity from Laos

-

7th December 2017

Source: Myanmar TimesRegional demand for Myanmar beans offsets Indian restrictions

-

26th November 2017

Source: Vientiane TimesLao PDR - Ministry takes steps to improve tourism services

-

25th November 2017

Source: VietNamNet BridgeViet Nam - Economic strategy must include natural disaster prevention

-

25th November 2017

Source: The NationMekong region cities ‘face same problems’

-

24th November 2017

Source: The Nation‘One Belt, One Road’ initiative underway, but experts warn of difficulties ahead

-

21st November 2017

Source: Mekong EyeChina moots economic corridor with Myanmar for easy access to Indian Ocean

-

19th November 2017

Source: Vientiane TimesLaos, China agree to promote industry, trade ties

-

19th November 2017

Source: Vientiane TimesXi’s state visit sees Laos’ investment profile, opportunities rise

-

16th November 2017

Source: The DiplomateCambodia - A Bright Future in Cambodia’s Energy Sector?

-

13th November 2017

Source: VietNamNet BridgeVietnam leader calls for stronger ties at Mekong-Japan, ASEAN-UN summits

-

13th November 2017

Source: Lao News AgencyChinese President Xi Jinping Wraps up State Visit to Lao PDR

-

9th November 2017

Source: Vientiane TimesLaos, China expect to ink 17 deals

-

1st November 2017

Source: WWFTop 10 'Most Wanted' Endangered Species in the Markets of the Golden Triangle

-

1st November 2017

Source: The NationGolden Triangle is ‘ground zero’ for wildlife trafficking: WWF

-

31st October 2017

Source: VietNamNet BridgeViet Nam - Target programme for climate change response and green growth approved

-

26th October 2017

Source: Khmer TimesCambodia - Best rice to be decided in national competition

-

24th October 2017

Source: MizzimaMyanmar to reap greater rewards in deep-sea port development project

-

23rd October 2017

Source: Laos News AgencyLaos Sets Ambitious Plan to Attract 5.2 Million Tourists In 2018

-

19th October 2017

Source: Bangkok PostNew Thai-Cambodian MoU on border trade

-

19th October 2017

Source: Khmer TimesCambodia - Plans to ‘export chicken egg’ bananas

-

19th October 2017

Source: Khmer TimesCambodia - Singapore asked to increase its imports

-

14th October 2017

Source: Asian TribuneChina’s Myanmar bonanza sans responsibility

-

10th October 2017

Source: Vientiane TimesLaos, Vietnam speeding up oil pipeline project

-

5th October 2017

Source: Vientiane TimesLao PDR - Authorities fail to collect sufficient SEZ revenue

-

5th October 2017

Source: Khmer TimesCambodia - Rice exports just keep on growing

-

5th October 2017

Source: Myanmar TimesMyanmar diesel imports rise as rice exports improve

-

3rd October 2017

Source: Lao News AgencyLao PDR - Laos’ Growth Projected to Moderate to 6.7 %, Says World Bank

-

3rd October 2017

Source: Vientiane TimesLao PDR - Chinese investor gears up to develop Khonphapheng SEZ

-

28th September 2017

Source: Vientiane TimesLaos sells 100MW electricity to Malaysia

-

27th September 2017

Source: Bangkok PostThailand - Mekong clearance will destroy 'a few islets'

-

27th September 2017

Source: Khmer TimesCambodia - $50m boost for farming

-

27th September 2017

Source: WCS-CambodiaCambodia - Vietnam Joint Efforts to Combat Transborder Wildlife Trafficking

-

26th September 2017

Source: Vientiane TimesADB to support inclusive, sustainable growth in Laos

-

26th September 2017

Source: Myanmar TimesASEAN trade pact strengthens Myanmar’s ties with Australia, New Zealand

-

25th September 2017

Source: Khmer TimesTourism boost for Cambodia

-

25th September 2017

Source: Khmer TimesCambodia, Bangladesh to strengthen trade

-

25th September 2017

Source: Khmer Times$64b GMS action plan

-

24th September 2017

Source: Myanmar TimesMyanmar - Japan offers to import brown sugar

-

24th September 2017

Source: Khmer TimesMore than 300 French firms eye Cambodia

-

23rd September 2017

Source: The NationThailand - Rhino-horn smugglers arrested at airport

-

21st September 2017

Source: Myanmar TimesASEAN countries “keen” and “ready” for Belt and Road: HKTDC

-

20th September 2017

Source: ADBNew ADB-Lao PDR Strategy to Support Inclusive, Sustainable Growth

-

14th September 2017

Source: Khmer TimesCambodia-Thai-Vietnam bus service

-

13th September 2017

Source: Khmer TimesCambodia to host 2018 China-Asean Expo

-

13th September 2017

Source: The Phnom Penh PostCambodia - Kingdom’s biggest SEZ to get even bigger

-

12th September 2017

Source: Eco-BusinessDamned if you do, damned if you don’t: Myth-busting on the Mekong’s hydropower dams

-

11th September 2017

Source: The Manila TimesChina-Asean expo seeks to boost trade, investment

-

10th September 2017

Source: Vientiane TimesLao PDR - Govt vows to further boost economic growth

-

10th September 2017

Source: Myanmar TimesChina-Myanmar gas power plant to be completed on schedule in 2018

-

10th September 2017

Source: Ministry of Environmental ProtectionChinese vice premier stresses green development

-

8th September 2017

Source: National News Bureau of ThailandThailand - Agriculture Ministry to link organic rice market with GAP rice market

-

7th September 2017

Source: Myanmar TimesWWF-Myanmar sounds alarm about illegal wildlife trade

-

7th September 2017

Source: The NationSilence on suspended dam deal as Prayut and Hun Sen agree to stronger bilateral ties

-

5th September 2017

Source: The NationThailand - Prayut suspends Bt40-bn Cambodian dam project

-

5th September 2017

Source: Khmer TimesCambodia - Blackwell Global now in Cambodia

-

4th September 2017

Source: Eco-BusinessRising temperatures cut economic output

-

3rd September 2017

Source: Khmer TimesCambodia - Positive start for bilateral talks

-

3rd September 2017

Source: Myanmar TimesMyanmar - Struggle in the agriculture sector

-

28th August 2017

Source: ADBReport Calls on Creation of National Green Financing Mechanisms to Accelerate Green Growth in Asia

-

24th August 2017

Source: Vientiane TimesLao PDR - Banana exports drop after govt tightens regulations on growers

-

24th August 2017

Source: Khmer TimesRussia-Cambodia body mooted

-

23rd August 2017

Source: Khmer TimesCambodia - Oil deal finally gets signed

-

19th August 2017

Source: The NationThailand - PM aims to turn Northeast into ‘Mekong economic hub’

-

18th August 2017

Source: Viet Nam NewsThailand - APEC seeks boost to food security, sustainable agriculture growth

-

15th August 2017

Source: Bangkok PostMyanmar opts for domestic power generation

-

14th August 2017

Source: National News Bureau of Thailand (NNT)Thailand - Agriculture and Cooperatives Min to hold Agricultural fair from 16-20 Aug

-

13th August 2017

Source: The NationThailand - Auditor-General rejects complaints about rice sales

-

13th August 2017

Source: Vientiane TimesLaos, India further enhance trade, investment, tourism cooperation

-

13th August 2017

Source: Vientiane TimesLao PDR - Weavers raw over rising silk prices

-

10th August 2017

Source: Myanmar TimesASEAN touted by EU firms as an alternative to China

-

6th August 2017

Source: The Phnom Penh PostCambodia - Growth spurt of exports to Japan weakens in H1

-

2nd August 2017

Source: Myanmar TimesMyanmar’s stakes in two Belt and Road economic corridors

-

1st August 2017

Source: Khmer TimesCambodia - New rail link boosts Phnom Penh property developer confidence

-

26th July 2017

Source: Myanmar TimesMyanmar to receive revenues from China-Myanmar crude oil pipeline

-

20th July 2017

Source: Myanmar TimesMyanmar - Garment factory installs rooftop solar PV to fend off rising electricity cost

-

19th July 2017

Source: ADBADB Sees Improved Growth Prospects for Developing Asia

-

16th July 2017

Source: Khmer TimesCambodia tourism to get Chinese help

-

14th July 2017

Source: MizzimaThe construction of BCIM Economic Corridor vs. Myanmar

-

14th July 2017

Source: The NationMekong Institute shifts its aid focus

-

13th July 2017

Source: Myanmar TimesSingapore’s MOSB to become first foreign oil and gas supply base in Myanmar

-

12th July 2017

Source: MizzimaMyanmar opens arms for the first foreign company to build an oil and gas supply base

-

11th July 2017

Source: Vientiane TimesLao PDR - Govt to pursue 7 percent economic growth in 2018

-

11th July 2017

Source: The Phnom Penh PostCambodia - China’s appetite driving rice export growth as demand continues to outstrip supply

-

6th July 2017

Source: TTR WeeklyCambodia maps ecotourism policy

-

4th July 2017

Source: Khmer TimesCambodia - Tourism, environment bodies planning to work together

-

3rd July 2017

Source: Khmer TimesCambodia - Chinese encouraged to invest more

-

2nd July 2017

Source: Vientiane TimesLao PDR - Australia increases ODA to Laos with education, trade development focus

-

2nd July 2017

Source: VN ExpressViet Nam - $2.8 bln power plant makes Japan Vietnam’s biggest foreign investor in H1

-

1st July 2017

Source: VN ExpressViet Nam - Ho Chi Minh City plans $3.6 billion rail connection with Mekong Delta

-

28th June 2017

Source: VietNamNet BridgeViet Nam - Low-carbon economy in Vietnam’s updated NDC

-

28th June 2017

Source: VietNamNet BridgeViet Nam - Tourism plans in Mekong Delta called too ambitious

-

26th June 2017

Source: Khmer TimesCambodia - Thais eye Keo Romeat mangoes

-

25th June 2017

Source: Vientiane TimesLao PDR - Demarcation complete, Luang Prabang eyes investment to push SEZ project ahead

-

21st June 2017

Source: Lao News AgencyLao-Viet Expo 2017 to Be Held This Month

-

18th June 2017

Source: VN ExpressVietnam’s legislators approve to fast-track multi-billion-dollar airport

-

14th June 2017

Source: Nikkei Asian ReviewMekong subregion shapes up for tourism influx

-

13th June 2017

Source: VietNamNet BridgeAir pollution in Vietnam threatens economic growth

-

7th June 2017

Source: Lao News AgencyBilateral Lao-Thai Trade Set to Double

-

7th June 2017

Source: Khmer TimesCambodia - Mango exporter unfazed by Qatar crisis

-

5th June 2017

Source: Khmer TimesCambodia - Qatar crisis sparks tourism fears

-

5th June 2017

Source: Myanmar TimesChina-Myanmar Border Economic Cooperation Zone location speculated

-

5th June 2017

Source: Khmer TimesCambodia - Cashew growers brace for fall in prices

-

4th June 2017

Source: Myanmar TimesMyanmar - Pipelines will supply oil and gas to Myanmar for domestic consumption

-

4th June 2017

Source: Khmer TimesCambodia - Decision time for rice brand

-

4th June 2017

Source: Myanmar TimesMyanmar - Investor-friendly environment and human capital essential for Myanmar’s success in the Belt and Road Initiative

-

31st May 2017

Source: Ministry of Environmental ProtectionChina - Xi stresses green development

-

31st May 2017

Source: Nikkei AsianViet Nam - Trump hails signing of deals worth 'billions' with Vietnam

-

31st May 2017

Source: Nikkei AsianASEAN exports and consumption are up, but for how long?

-

31st May 2017

Source: Myanmar TimesMyanmar - Riverine trade boost after Mandalay Jetty upgrade

-

31st May 2017

Source: Khmer TimesCambodia - EU delays ban of fungicide in rice

-

30th May 2017

Source: Myanmar TimesThe high road to warmer Myanmar-China ties

-

30th May 2017

Source: ADBADB Promotes Harmonized Food Safety, Market Access in GMS

-

29th May 2017

Source: Myanmar TimesMyanmar - Myanmar coffee exports to stimulate agro sector

-

29th May 2017

Source: Lao News AgencyLao PDR - Foreign Visitor Arrivals Decrease by 11% in Q1

-

28th May 2017

Source: Eco-BusinessAgribusinesses can help ASEAN achieve the SDGs

-

28th May 2017

Source: Khmer TimesCambodia - Export markets for Kampot pepper keep growing strong

-

26th May 2017

Source: Mekong EyePaying for progress: Getting the private sector to pull its weight

-

24th May 2017

Source: Vientiane TimesLaos, Thailand boost trade, investment cooperation

-

24th May 2017

Source: Vientiane TimesLao PDR - Govt takes step to develop VungAng Seaport

-

24th May 2017

Source: Myanmar TimesChina buys up Myanmar’s entire mango export

-

24th May 2017

Source: Myanmar TimesMyanmar tea leaves get Japanese technology

-

24th May 2017

Source: Bangkok PostThai-Sino high-speed rail work could start by August

-

23rd May 2017

Source: VietNamNet BridgeViet Nam - Enterprises to combat illegal trade of wildlife

-

23rd May 2017

Source: Khmer TimesCambodia - Cross-border highways vital for bilateral trade

-

23rd May 2017

Source: Myanmar TimesMyanmar - Joint-venture granted licence to trade machine oil

-

23rd May 2017

Source: Myanmar TimesChina and Myanmar to set up Border Economic Cooperation Zone

-

22nd May 2017

Source: VietNamNet BridgeViet Nam - Air pollution challenges Vietnam’s socio-economic development

-

22nd May 2017

Source: Viet Nam NewsViet Nam - Disasters a threat to VN development

-

22nd May 2017

Source: National News Bureau of Thailand (NNT)Thailand - FMO holding 2nd Chatuchak Fish Market

-

22nd May 2017

Source: The NationAs Asean turns 50, region’s leaders must prepare young generation for the future

-

22nd May 2017

Source: Vientiane TimesLao PDR - Vietnam looking to import cattle to meet increasing demands

-

21st May 2017

Source: Vientiane TimesLao PDR - Oil pipeline project to cut petrol prices

-

21st May 2017

Source: Vientiane TimesLaos has yet to fully benefit from trade privileges

-

21st May 2017

Source: Myanmar TimesMyanmar - Two countries one destination with Cambodia planned

-

20th May 2017

Source: Mekong EyeChina’s ‘Belt and Road’ Policy Benefits Cambodia, Analysts Say

-

18th May 2017

Source: Myanmar TimesMyanmar - Rejoining Asia’s rice bowls

-

17th May 2017

Source: VietNamNet BridgeVietnam among Asia’s growth leaders

-

17th May 2017

Source: Khmer TimesCambodia - New airline plans Thai flights

-

17th May 2017

Source: Khmer TimesCambodia - World Bank warns of risks to growth

-

17th May 2017

Source: Vientiane TimesLao PDR - Plans gather steam for railway linking Vientiane to Vietnamese seaport

-

17th May 2017

Source: The Phnom Penh PostCambodia - PM: China raises rice quota

-

15th May 2017

Source: Ministry of Environmental ProtectionChina - List of Deliverables of the Belt and Road Forum for International Cooperation

-

15th May 2017

Source: Khmer TimesCambodia - Ministry predicts stable GDP growth

-

14th May 2017

Source: Agence Kampuchea PresseCambodia Is One of the Main Supporters of the Belt and Road Initiative

-

14th May 2017

Source: Ministry of Environmental ProtectionChina - Four ministries jointly issued the Guidance on Promoting Green Belt and Road

-

14th May 2017

Source: Ministry of Environmental ProtectionUNEP to boost a green Belt and Road Initiative

-

14th May 2017

Source: ABC NewsChina wants to dynamite the Mekong River to increase trade

-

14th May 2017

Source: Bangkok PostThailand - First-quarter growth fastest in four years

-

12th May 2017

Source: MizzimaMyanmar - 1st Myanmar-China Think Tank Forum held in China

-

11th May 2017

Source: Khmer TimesAsean hails a regional techno future

-

11th May 2017

Source: Khmer TimesAsia rice buyers turn to Vietnam

-

11th May 2017

Source: Khmer TimesAsean urged to ‘leapfrog’ into digital economy

-

11th May 2017

Source: Ministry of Environmental Protection (MEP)China - Scientists set sustainable development goals for Belt and Road

-

10th May 2017

Source: Ministry of InformationMyanmar - Maubin Industrial Park project starts to be implemented

-

10th May 2017

Source: MizzimaChina, Myanmar must cooperate to overcome challenges on Belt and Road

-

10th May 2017

Source: Vientiane TimesLao PDR - President to attend Road and Belt Forum in China

-

10th May 2017

Source: Lao News AgencyLao PDR - Vang Vieng Tourism Industry Witnesses 70 Billion Kip in Circulation

-

10th May 2017

Source: Lao News AgencyLaos, Cambodia Boost Bilateral Cooperation Ties

-

10th May 2017

Source: Ministry of InformationMyanmar - Rice exports declined in April

-

7th May 2017

Source: ADBAfter 50 years, Asian Development Bank looks ahead

-

7th May 2017

Source: Khmer TimesCambodia - Kampot seaport construction to start

-

29th April 2017

Source: National News Bureau of Thailand (NNT)Thailand - Online wildlife trader arrested in Samut Prakan

-

26th April 2017

Source: VietNamNet BridgeVietnam charts course towards green economy

-

26th April 2017

Source: The Myanmar TimesMyanmar - Yangon to upgrade markets with PPP system

-

25th April 2017

Source: Vientiane TimesLao PDR - Cross-border bridge congestion target of Savan Park proposal

-

24th April 2017

Source: Khmer TimesCambodia - Bridge strengthens bilateral trade ties

-

24th April 2017

Source: Khmer TimesCambodia - More rice exporters given access to China

-

24th April 2017

Source: Lao News AgencyLao PDR - GDP Growth in 2016 Lower Than Expected

-

23rd April 2017

Source: The Myanmar TimesMyanmar - World Bank to loan $100 million to Myanmar Financial Development Project

-

13th April 2017

Source: National News Bureau of Thailand (NNT)Thailand - South rubber market recuperates after price hike

-

10th April 2017

Source: MizzimaChina, Myanmar ink oil pipeline deal

-

3rd April 2017

Source: Khmer TimesCambodia - Cassava exports up, prices low

-

3rd April 2017

Source: Khmer TimesCambodia - Slow bounce for rubber price

-

3rd April 2017

Source: Vietiane TimesLaos-China direct flight serves to promote cooperation

-

2nd April 2017

Source: The Myanmar TimesMyanmar-China crude oil pipeline to commence next month

-

2nd April 2017

Source: MizzimaChina remains Myanmar’s largest foreign investor

-

2nd April 2017

Source: Lao News AgencyLao PDR - Agricultural Promotion Bank Provides Almost LAK 70 Billion in Loans in Sekong

-

30th March 2017

Source: The Phnom Penh PostCambodia - Seaport operator cruises toward IPO

-

30th March 2017

Source: Khmer TimesCambodia - Airports raise a smile

-

29th March 2017

Source: Khmer TimesUS, Cambodia trade reaches $3 billion

-

29th March 2017

Source: Vientiane TimesLao PDR - New tourist attraction to boost economy in Khong district

-

29th March 2017

Source: The Phnom Penh PostCambodia - Oil firm ready to ink production-sharing agreement

-

29th March 2017

Source: Eco-BusinessDespite growth, one in 10 Asians live in extreme poverty

-

28th March 2017

Source: The Phnom Penh PostCambodia - Exports of logs double in 2016

-

27th March 2017

Source: Khmer TimesCambodia opens trade center in Shaanxi

-

27th March 2017

Source: MizzimaSino-Myanmar oil pipeline launch a good signal: experts

-

27th March 2017

Source: The Phnom Penh PostCambodia - Coastal economy rises on tourist tide

-

27th March 2017

Source: Agence Kampuchea PresseCambodia - US$7 Million from Sweden to Promote Cambodia’s SMEs

-

26th March 2017

Source: VietNamNet BridgeViet Nam - The green economy needs the right kind of FDI: gov't

-

26th March 2017

Source: Bangkok PostThailand - New setback looms for Thai-Sino rail project

-

26th March 2017

Source: Vientiane TimesLao PDR - Garment exports decline by 5 percent

-

26th March 2017

Source: MizzimaMyanmar - Trade between Myanmar, Middle East reaches over 300 million USD in past 10 months to January

-

26th March 2017

Source: Ministry of InformationMyanmar - Exports from fishery sector fetched over US$500million this FY

-

26th March 2017

Source: UNEPWorld green economy leaders look for ways to spark a new green revolution – and set a path to the 2030 Agenda

-

23rd March 2017

Source: Vientiane TimesLao PDR - Forestry agreement inked as Laos, China pursue sustainable resource development

-

22nd March 2017

Source: The Myanmar TimesMyanmar - Joint-venture between British and Myanmar firms eyes oil and gas sector

-

21st March 2017

Source: Vientiane TimesLao PDR - Rice exports to China still facing challenges, official says

-

21st March 2017

Source: ElevenMyanmar - Landslide in Chin State causes temporary suspension of border trade

-

20th March 2017

Source: Khmer TimesCambodia - Traders urged to use Riel

-

20th March 2017

Source: Vientiane TimesLao PDR - Tunnel boring for Laos-China railway expected in coming weeks

-

20th March 2017

Source: Lao News AgencyLao PDR - Vietnam's Vung Ang Port vital for shipment of Lao goods

-

20th March 2017

Source: The Myanmar TimesMyanmar - Rice export behind target, to focus on quality

-

19th March 2017

Source: MizzimaMyanmar - New economic zones planned

-

19th March 2017

Source: Khmer TimesCambodia - Wing-Mingalabar partnership

-

19th March 2017

Source: Khmer TimesNew airline launches in Cambodia

-

19th March 2017

Source: Myanmar TimesMyanma Timber Enterprise to respond to Danish teak sanctions

-

19th March 2017

Source: ADBADBNews: ADB President Pledges Strong Support for PRC’s Reforms

-

15th March 2017

Source: MizzimaMyanmar - Denmark sanctions entire Myanmar teak industry

-

15th March 2017

Source: The NationThailand - Tense standoff between protesters and police over Pak Bara deep-sea port

-

15th March 2017

Source: UNEPSmarter use of resources can add $2 trillion annually to global economy

-

14th March 2017

Source: Khmer TimesAsean moving into RCEP

-

14th March 2017

Source: Khmer TimesCambodia - Palm oil price drop to hit local market

-

14th March 2017

Source: The Myanmar TimesASEAN must brace for uncertain 2017

-

12th March 2017

Source: Khmer TimesCambodia - Checks for rice exporters

-

12th March 2017

Source: Agence Kampuchea PresseRussian Investors Interested in Investment in Cambodia

-

12th March 2017

Source: Agence Kampuchea PresseCambodia, Thailand To Establish Joint Committee on Border Trade

-

12th March 2017

Source: WBLao PDR to Improve Trade and Business Environment

-

10th March 2017

Source: East Asia ForumCan Myanmar’s garment industry deliver decent jobs?

-

10th March 2017

Source: MizzimaLancang-Mekong Cooperation secretariat opens

-

9th March 2017

Source: Khmer TimesCambodia - Expanding trade and tourism

-

9th March 2017

Source: Ministry of Natural Resources and EnvironmentVietnam not tradingoff environment for economic growth

-

6th March 2017

Source: Agence Kampuchea PresseCambodia - Banteay Meanchey, Vinh Long Sign MoU on Trade and Tourism Cooperation??? for 2016-2020

-

6th March 2017

Source: VNExpressMexico's rice import plan may open door for Vietnamese grain

-

5th March 2017

Source: VNExpressVietnam joins world's happiest economies

-

1st March 2017

Source: Lao News AgencyLao Skyway Launches New Flight

-

1st March 2017

Source: VNExpressVietnam's super-rich population is growing faster than anywhere else

-

25th February 2017

Source: National News Bureau of Thailand (NNT)Thailand - Govt pushes forward ThaiGAP to upgrade quality of Thai agricultural products

-

14th February 2017

Source: MizzimaMyanmar should improve investment environment to get more Chinese funds

-

8th February 2017

Source: Ministry of Environmental Protection (MEP)China encourages environmentally friendly IPOs

-

31st January 2017

Source: ADBADB-Op-eds: Connecting Asia's growth poles

-

30th January 2017

Source: Khmer TimesCambodia eyes bond market

-

26th January 2017

Source: Khmer TimesCambodia - Heavy spending for Chinese New Year

-

26th January 2017

Source: Eco-BusinessHow green are your bonds?

-

26th January 2017

Source: VNExpressVietnam 2017: Prospects and challenges

-

26th January 2017

Source: TRAFFICNew study finds gall bladder the main draw for Myanmar bear poachers

-

25th January 2017

Source: Khmer TimesBangladesh eyes Cambodia trade

-

25th January 2017

Source: The Myanmar TimesMyanmar - Fuel imports jump on Chinese re-export trade

-

25th January 2017

Source: The Myanmar TimesMyanmar - Mango farming gets GAP stamp

-

25th January 2017

Source: Bangkok PostLaos buys fewer Thai goods after VAT at Friendship Bridge

-

24th January 2017

Source: The Myanmar TimesMyanmar to discuss rice exports with Sri Lanka

-

24th January 2017

Source: MizzimaChina-Myanmar gas power plant to ease electricity shortages in Yangon by year-end

-

23rd January 2017

Source: The Myanmar TimesMyanmar - Struggling farmers want more government support

-

23rd January 2017

Source: Eco-BusinessAsia firms slump in sustainability rankings

-

23rd January 2017

Source: The Phnom PenhCambodia - Kingdom’s economy insulated: officials

-

23rd January 2017

Source: ADBADB Infographic - Data Show 50 Years of Changing Asia

-

22nd January 2017

Source: Bangkok PostThailand - Get ready for visitor inrush, PM tells agencies

-

22nd January 2017

Source: Lao News AgencyLao PDR, Cambodia Strengthen Cross-Border Cooperation for Sustainability

-

19th January 2017

Source: Eco-BusinessAt Davos forum, UN chief Guterres calls businesses ‘best allies’ to curb climate change, poverty

-

18th January 2017

Source: Bangkok PostUAC ready to finalise Myanmar power deal

-

17th January 2017

Source: The NationNew Mekong River blasting project will only benefit China: experts

-

16th January 2017

Source: The Phnom Penh PostCambodia - A more direct path for mango exports

-

16th January 2017

Source: Khmer TimesCambodia - Poipet checkpoint to be upgraded, enlarged

-

16th January 2017

Source: Khmer TimesCambodia - Chinese to transform coastal provinces

-

16th January 2017

Source: Lao News AgencyLaos to Export Electricity to Myanmar

-

15th January 2017

Source: MizzimaMyanmar earns over 1 bln USD from beans, pulses export in first 9 months of 2016-17

-

14th January 2017

Source: National News Bureau of Thailand (NNT)Thailand - Agricultural cooperative in Chiang Mai plans to increase rice exports to China

-

12th January 2017

Source: Khmer TimesCambodia - Expressway to Vietnam on cards

-

12th January 2017

Source: Khmer TimesCambodia - Cassava woes still persist

-

12th January 2017

Source: Viet Nam NewsViet Nam - Graffiti calls for end to rhino horn use in Vi?t Nam

-

12th January 2017

Source: The Phnom Penh PostCambodia - Plans for solar-powered industrial park illuminated

-

12th January 2017

Source: BloombergAsia's Smallest Economies Are Among Its Fastest Growing

-

12th January 2017

Source: The Phnom Penh PostCambodia - Firmer prospects as rubber rebounds

-

11th January 2017

Source: mizzimaVisa welcomes opening of Myanmar’s domestic payments industry

-

11th January 2017

Source: Agence Kampuchea PresseCambodia Hosts Consultation Meeting on Climate-friendly Agribusiness Value Chains Sector

-

11th January 2017

Source: Lao News AgencyIFC Promotes Increased Access to Credit in Laos

-

11th January 2017

Source: Mekong EyeBeyond Sustainable Development for ASEAN

-

11th January 2017

Source: TRAFFIC (the wildlife trade monitoring network)Wild plant harvesters gain insights from a successful cooperative model in Viet Nam

-

10th January 2017

Source: National News Bureau of Thailand (NNT)Thailand - Commerce Ministry aimed to release all rice in state warehouses before end of year

-

9th January 2017

Source: Bangkok PostThailand - State seeks to buoy tapioca

-

9th January 2017

Source: The Myanmar TimesMyanmar - MAPCO courts investment for agri-industry park

-

9th January 2017

Source: Khmer TimesCambodia - Trade hope as border gate opens

-

9th January 2017

Source: ADBADB's new strategy in Asia: Helping build quality infrastructure at scale

-

9th January 2017

Source: mizzimaAs catch and sales fall, Myanmar fishermen sink into debt

-

8th January 2017

Source: Bangkok PostThailand - Locals slam Mekong blasting plan

-

8th January 2017

Source: Khmer TimesCambodia pushes for e-commerce initiative

-

8th January 2017

Source: The Cambodia DailyCambodia - Slowing Rice Export Growth ‘Worrisome’

-

8th January 2017

Source: The Phnom Penh PostCambodia - Decline in transfers linked to rice prices

-

8th January 2017

Source: ADBADB News - ADB Operations Reach a Record $31.5 Billion in 2016

-

8th January 2017

Source: The Myanmar TimesMyanmar - Rakhine commerce minister sees bright future for black bean exports

-

8th January 2017

Source: Burma News InternationalMyanmar - Mon State Gov’t requests EIA from investing companies in the State

-

5th January 2017

Source: Khmer TimesCambodia - Kampot seaport to boost tourism

-

5th January 2017

Source: Agence Kampuchea PresseCambodia To Launch Trade Center in China’s Shaanxi Province

-

5th January 2017

Source: The Myanmar TimesMyanmar - Resource ministry plans reduction in export eligible timber

-

5th January 2017

Source: China DialogueChina - Hydro expansion will fail without energy market reform

-

5th January 2017

Source: WCS-Cambodia (Wildlife Conservation Society)Dep Oun leads Tmatbouy to Be Community Ecotourism Protected Area model in Cambodia

-

4th January 2017

Source: Vientiane TimesLao PDR - Economists, private sector optimistic about strong Lao economy in 2017

-

4th January 2017

Source: mizzimaMyanmar - Myanmar’s tourism industry shows promise but has a long way to go

-

29th December 2016

Source: The Myanmar TimesMyanmar - Farming sector faces uncertain 2017

-

29th December 2016

Source: Khmer TimesCambodia - Key Figures and Their Forecasts for Cambodia’s Economy in 2017

-

26th December 2016

Source: The IrrawaddyMyanmar - Plans Announced for SEZ and New Airport Terminal in Southern Rangoon

-

22nd December 2016

Source: The Myanmar TimesMyanmar - Natural gas export earnings slump

-

19th December 2016

Source: Ministry of Natural Resources and EnvironmentViet Nam held an international exhibition on environmental technologies and eco-products

-

12th December 2016

Source: The NationChinese banana farms in Laos halted for using hazardous chemicals

-

7th December 2016

Source: ADBADB to Support Cross-Border Economic Activities Between Viet Nam and Guangxi, PRC, with $450 Million Loan

-

9th November 2016

Source: WWF News ReleaseDevelopment on the Mekong River Risks Entire Region’s Economy: WWF Report

-

2nd November 2016

Source: ADBADB: Key Indicators 2016 - Fast Data

-

29th October 2016

Source: Ministry of InformationMyanmar - Government to reduce service costs through cooperation with entrepreneurs

-

28th October 2016

Source: National News Bureau of Thailand (NNT)Thailand - PM to find measures to help rice farmers on 31 October

-

27th October 2016

Source: The Myanmar TimesMyanmar - Debt fears rise as border trade declines

-

24th October 2016

Source: Agence Kampuchea Presse (AKP)Cambodian PM Arrives in Hanoi for Regional Meetings

-

21st October 2016

Source: The IrrawaddyMyanmar - Govt Unveils Detailed Economic Policies

-

13th October 2016

Source: The Myanmar TimesUS-Myanmar consortium wins 300-megawatt power plant bid

-

9th October 2016

Source: The Myanmar TimesMyanmar - Industrial sector says policy details are needed to ensure economic zones grow

-

5th October 2016

Source: The Myanmar TimesMyanmar - Low production and quality to blame for rubber sector’s export woes

-

4th October 2016

Source: Agence Kampuchea PresseCambodia, ADB Discuss Future Cooperation and Macroeconomic Progress

-

4th October 2016

Source: Agence Kampuchea PresseWB Retains Positive Forecast of Cambodia’s Economic Growth

-

4th October 2016

Source: Lao News AgencyLao PDR: Economic Growth to Remain Robust through 2018

-

2nd October 2016

Source: VietNamNet BridgeBiz doubts VN’s engagement in climate policies

-

2nd October 2016

Source: The CambodiadailyXi to Make First Presidential Visit This Month

-

2nd October 2016

Source: WWF-ThailandNew Push to Close Domestic Ivory Markets, including Thailand’s

-

29th September 2016

Source: The? Phnom Penh PostPhnom Penh preparing for Xi Jinping’s visit

-

27th September 2016

Source: WWF-ThailandWWF and TRAFFIC: New ETIS Data Show Ivory Trafficking Reaches Historic Levels

-

26th September 2016

Source: ADBADB Retains Forecast of Strong Growth for Cambodia’s Economy in 2016, 2017

-

26th September 2016

Source: WWF-LaosLao PDR - 3,500 rattan baskets are currently being inspected and made ready for shipping to European markets

-

25th September 2016

Source: The GuardianRevealed: the criminals making millions from illegal wildlife trafficking

-

25th September 2016

Source: Bangkok PostTies with Cambodia enter 'new chapter'

-

15th September 2016

Source: GMS-EOCADB: GMS e-Newsletter May-August 2016

-

12th September 2016

Source: China Radio International (CRI)China-ASEAN Expo brings closer Asian Economies

-

10th September 2016

Source: XinhuaChina - Environmental protection top priority of Yangtze River economic belt development

-

10th September 2016

Source: China Daily13th China-ASEAN Expo opens in Guangxi

-

6th September 2016

Source: China DailyJoint Statement of the 19th ASEAN-China Summit to Commemorate the 25th Anniversary of ASEAN-China Dialogue Relations

-

5th September 2016

Source: The Phnom Penh PostCambodia - Legislation to regulate eco-tourism segment

-

4th September 2016

Source: Mekong EyeGigawatts for Gigaspenders: Infographic shows Bangkok’s luxury malls use more energy than some provinces

-

30th August 2016

Source: VietNamNet BridgeViet Nam - Wildlife trafficking continues despite tough laws

-

24th August 2016

Source: Ministry of Natural Resources and EnvironmentViet Nam - Environment is not to be traded off for economic benefits

-

23rd August 2016

Source: The NationChina, Asean ‘need fast RCEP deal’

-

21st August 2016

Source: GoKunmingDelayed dam, rebel groups dominate Suu Kyi's China visit

-

12th August 2016

Source: XinhuaState Council nods new opening-up pilot zone in southwest China

-

12th August 2016

Source: XinhuaChina to step up support for green sector: top economic planner

-

9th August 2016

Source: ADBADB Sells $1.3 Billion in Global Green Bonds to Spur Climate Financing

-

8th August 2016

Source: Agence Kampuchea Press (AKP)Cambodia Hosts 8th GMS Economic Corridors Forum

-

4th August 2016

Source: China dailyHighway corridor links Chongqing to SE Asia

-

31st July 2016

Source: National News Bureau of Thailand (NNT)Thailand and Pakistan strengthen agricultural cooperation

-

31st July 2016

Source: GMS-EOCGMS Officials to Reinvigorate Trade, Climate Friendly Agriculture Products

-

28th July 2016

Source: WWFThailand’s Tiger Temple Raid Highlights Need to Close Tiger Farms in Asia

-

27th July 2016

Source: Ministry of Environmental ProtectionChina - MEP launches national-scale environmental inspection on iron and steel industry

-

24th July 2016

Source: Vientiane TimesGovt approves legislation to serve development needs

-

18th July 2016

Source: Lao News AgencyLaos prepares to set up a Rubber Tree Association

-

18th July 2016

Source: Bangkok PostThailand considers buying more power from Laos

-

13th July 2016

Source: CNNBolaven Plateau: A coffee lover's utopia, deep in the heart of Laos